Letter to Shareholders - December 2025

Dear Silver Range shareholder:

May I begin by offering you and yours the compliments of the season and best wishes for 2026. I am writing on behalf of Silver Range to thank you for your support and to provide you with an update heading into the new year.

General market conditions

Gold prices are up 92% and silver prices have risen 129% since January 1, outpacing gains in both the general equity and smaller mining exploration equity markets. The interesting questions for the year ahead are will these gains be sustained and will they translate into a rally in junior mining stocks. My hunch is yes and yes – but slowly.

I’ll spare you a digression on precious metals and global finance beyond saying that I believe we are entering the final deleveraging stage of a generational-scale debt cycle, coincidentally involving a transfer of reserve currency status. If true, sustained high precious metal prices are in the cards for the foreseeable future.

Junior mining equity markets do not appear to have priced this in just yet. Using the TSX-V as a proxy for this sector, it is clear we have a long way to go to match the market activity seen during the last major rally at the end of the Great Financial Crisis. In fact, the Venture Exchange index is just about where it was during the dog days of the early 2000’s.

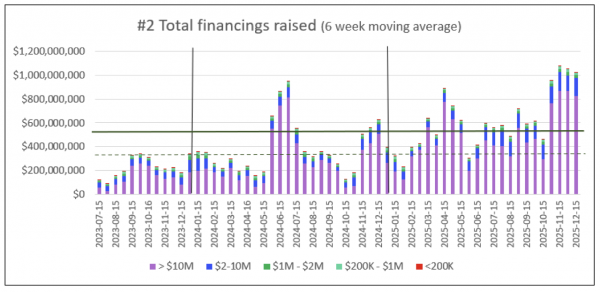

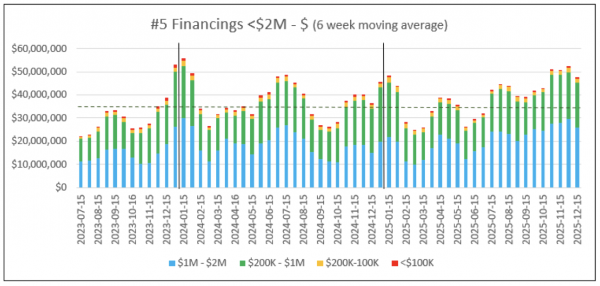

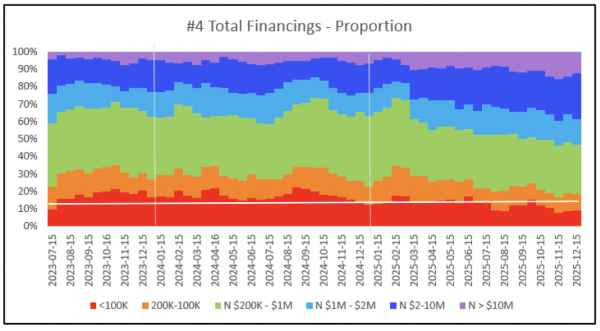

Financings are the lifeblood of the mining exploration industry given the long odds of success and realizing revenue. Since the nadir in summer 2023, we have been collecting and analyzing financings closed and money received in real time, checking daily SEDAR NI 45-105F submissions. As this data is much more granular and detailed than public market financing data, we spent some time normalizing this data against TSX-V data back to 2000 with the generous assistance of John Kaiser. We were able to decipher several key financing activity metrics to determine the health of the industry in real time. This is particularly important to Silver Range because we sell projects to other players rather than relying on continued financings for revenue. If they have no money, we have no sales. Here is a snapshot of market conditions to mid-December:

Total financings raised are in “good” territory, recently well above the $550M per two-week threshold for a good market. In fact, the unfiltered financings for December 1-15 were C$1.70B, the second highest since June 2023, second only to the latter half of October this year. In aggregate, markets are in good condition but keep in mind this figure is dominated by a small number of very large financings. At the bottom end of the market, it’s a different story. The amount of money being raised in critical smaller financings (< C$2M) is at best “okay”, beating the C$35M basement threshold.

Finally, the proportion of smaller financings (<C$200K) as a fraction of the total is still large, exceeding the 15% threshold we’d like to see for an “okay” market. Nonetheless it is improving and might turn soon.

In summary, markets are improving, led by the larger players. Overall however, conditions for most companies remain poor with access to capital for smaller green field projects constricted in particular. At current rates of improvement, we expect that conditions will be okay to good by Q2 2026 at the earliest.

Performance

As a shareholder, share price and volume are the only metrics that count. With that in mind, 2025 was an improvement with the Silver Range share price nearly doubling and volume increasing from abysmal levels last winter. We saw some activity in July connected with a junior mining stock “influencer” citing the stock as a buy for his or her younger followers.

For a longer-term perspective, here is our share price performance since we rebuilt the company as a prospect generator in 2016. I hope we are in the early days of a sustained share price and volume rally but that remains to be seen.

Financial condition

During 2025, we optioned 5 projects – a significant improvement over 2024. Realized revenue was up as we were able to monetize our position in Silver47. As of December 1, the company had C$2.67M cash in the bank, net of payables, and C$305K in marketable securities. We continue however to run a rather lean operation, focused on field work which will yield near term results.

Operations

Our operational concentration during the early stages of 2025 was on project sales and marketing and this remains a priority. Later in the year and with cash on hand, we were able to resume project generation and property exploration activities. Silver Range acquired the Alamo and Tesoro Properties in Arizona; staked and explored the Luxor and Quinn Properties in Nevada; and staked the Drum Property in Utah. The Sniper Property in Nevada was expanded from 4 to 14 claims, now covering important showings near Gold Mountain. In Arizona, field work concentrated on the Alamo Property which returned very high-grade gold and copper surface samples and responded well to soil samples and VLF-EM surveys. We completed a larger soil sampling program at Alamo by mid-December.

Finally, we significantly advanced our East Goldfield Project. In August, Centerra Gold announced that they were moving ahead with construction of the Goldfield Project on adjacent claims immediately west of our property holdings. At a town meeting in Goldfield during November, we learned that they planned on spending U$250M on the project in 2026. Naturally any mineral resources on a project adjacent to an operating mine will be of interest to the mine operator. During October, Precision Geosurveys Inc. completed an airborne total magnetic field and radiometric survey covering the property. In addition, with the kind assistance of the Nevada Bureau of Mines and Geology, we were able to obtain historic drill data on the East Goldfield Project and defined a Target for Exploration (not a NI 43-101 compliant resource) of 55,000 to 72,000 ounces of gold using 19 drill holes in the historic data. We followed this up during the fall by identifying and sampling 5 new surface targets, 4 of which returned assays meriting follow-up work. We conducted a foreshortened program of shallow diamond drilling in November. This employed small, man-portable gasoline powered drills which can be used without the requirement for prior permitting as they are considered “casual use” by the Bureau of Land Management. Six short holes were completed before the program was interrupted by heavy rain prior to Thanksgiving. We intend to complete this work during 2026. Our overall aim is to complete enough work on the property to qualify the project as a “property of merit” for the purposes of listing on the CSE or TSX-V. We are quite hopeful we can move this property through to option in 2026.

Finally, during the fall we retained the services of Julie Durant of Durant Media to enhance our corporate and investor marketing efforts. Expect to see changes in our digital, print and multimedia presence in the year ahead. We believe this will pay dividends as investor interest in our sector picks up.

Partner activities

In the year ahead, our share price may benefit from positive developments at properties optioned or owned by Silver Range partners where Silver Range retains an ownership interest, royalty or success fee.

- Excalibur Metals Corp. optioned our Bellehelen Project in December 2022 and was listed on the TSX-V in September 2025. Excalibur hit the ground running, staking additional claims and conducting surface exploration in anticipation of drilling in the new year.

- Rush Gold Corp. optioned our Skylight and Legal Tender Properties northwest of Tonopah in 2025. By year end they had completed surface sampling and hyperspectral surveys. They too plan on drilling in 2026.

- Walker Lane Resources Ltd. optioned our Tule Canyon, Cambridge and Silver Mountain Properties in May. They are currently financing and hope to begin exploration this spring.

- Finally, Broden Mining is approaching takeoff. In July 2016 Silver Range optioned the Silver Range Project near Faro Yukon to a group affiliated with Oxygen Capital Corp. In September 2021 they announced the formation of Broden Mining Corp. and their intent to reopen the Faro Mine. At one time, Faro was the largest lead-zinc mine in the western world and substantial historical (non-NI 43-101 compliant) resources were defined before the mining operation shut down in 2000. All known mineral resources in the Faro district are to be acquired by Broden Mining Corp., subject to conclusion of agreements with the Federal, Yukon and First Nations governments. From discussions with Broden management we understand that work is underway to draft and execute agreements early in the new year.

The year ahead

Our corporate objectives for 2026 are to continue building the company by:

- Judiciously monetizing third party shareholdings to augment our treasury.

- Maintaining an aggressive sales and marketing effort focused on vending our most prospective, drill-ready projects.

- Focusing on project generation in the near term during the winter months, likely involving staking in Nevada, Arizona and Utah.

- Resuming property exploration during the early spring. Our current priorities are to advance East Goldfield and Alamo and see them optioned in the short term.

- Advancing several of our most prospective second-tier projects to drill-ready status.

We are confident of eventual success. The prospect generator model continues to afford investors an excellent chance to participate in a mineral discovery. Precious metal prices remain strong, underpinned by a compelling narrative in these uncertain times. Markets are finally turning and a long boom may be ahead. Finally, our faith in the Southwest U.S. as a jurisdiction in which to find and develop a mine remains unshaken.

We believe that share price should be the prime metric by which shareholders should judge management performance. For junior mining companies, market capitalization and similar metrics are C-suite vanities, ultimately of no benefit to shareholders. Maintaining and enhancing our share price requires that we be disciplined in our spending, minimizing expenditures which do not add value to the company. We have been very fortunate to be able to refinance the company with no share dilution and intend to continue to run a frugal, cost-effective operation, maximizing return to shareholders.

Management has a large stake in the company, aligning our interests with yours. The President’s personal shareholdings have increased to 7.2% of the outstanding shares through private placements, taking shares as compensation for services, or by purchases in the open market to support the share price.

We hope returns to shareholders will come from share price appreciation associated with success on the part of our partners in exploring our projects. One need only look at the example of very successful prospect generators such as Altius, EMX Royalty or Globex to see what is possible. If we obtain an especially attractive project or develop a valuable package of royalties, we may spin these out into their own vehicles, again to the benefit of our shareholders. Lastly, there is always the possibility that the company may be taken over by a larger corporation attracted to the value we have created. We have been approached twice in the past few years with offers of this nature, neither of which were sufficiently lucrative to be pursued beyond the discussion stage.

We labor in hope that 2026 will be a much better year than 2025. We wish you a happy, healthy and prosperous 2026 and hope that Silver Range may contribute to that happy outcome.

Sincerely,

Mike Power, M.Sc., CPG

President, CEO & Director