Letter to Shareholders

Dear Silver Range shareholder:

May I begin by extending the compliments of the season to you and yours and best wishes for 2023. I am writing on behalf of Silver Range to thank you for your support and to provide you with an update heading into the new year.

Performance

As a shareholder, share price is the only metric that counts and this year has not been kind. With luck, we may end the year no worse than where we started at around $0.15. If there is any consolation in this it is that we have held up better than many of our peers.

As a precious metal prospect generator, our share price is strongly influenced by the price of gold and silver. After a promising start in the spring, both gold and silver lost ground during the summer and are only now rebounding. In the absence of company-specific market- moving news during 2022 our stock price mirrors the metal price trends.

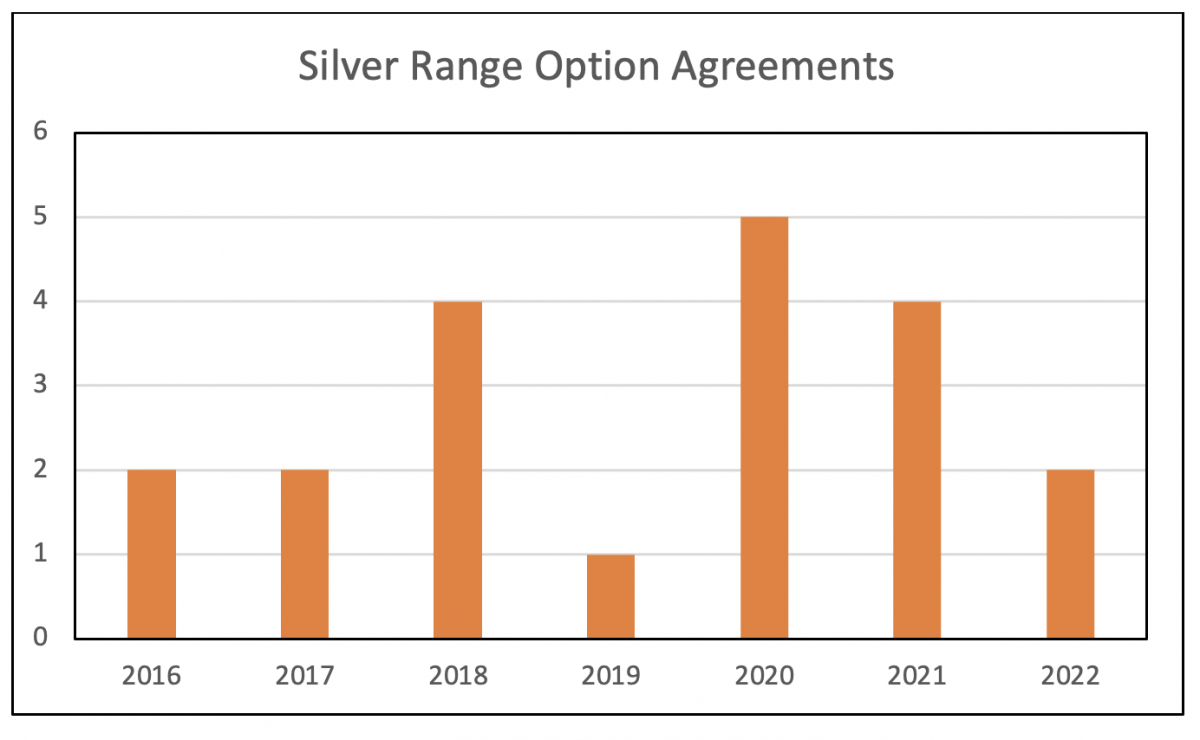

Closing option deals – our prime source of revenue – suffered along with our share price. With lower metal prices and lower investor interest in the precious metal sector, there are fewer companies actively looking for new gold and silver projects. This year we significantly increased our sales efforts but this is not reflected in the number of property options completed in 2022. We believe this work will bear fruit in the coming year assuming market conditions improve.

The lack of new options and the expiration of older options reduced revenue in 2022. After turning profits in both 2020 and 2021, Silver Range will likely show a loss in FY 2022. We anticipate opening a small financing in the new year to continue planned operations.

Market conditions

We believe 2023 will be a better year for gold and silver prices, for precious metal exploration, and for Silver Range. The underlying factors driving this will be inflation, currency flows and a new investment environment. The inflation genie is out of the bottle and central bankers around the world are struggling to contain it. Normally, rising interest rates could be relied on to tame inflation but after decades of easy credit, public and private debt levels are so high that there is an effective ceiling on these rates -somewhere in the neighborhood of 6%. Rates much higher than this could trigger very sharp recessions and sovereign debt defaults. Central bankers are quite cognizant of this and have amplified small, steady incremental interest rate increases with strong rhetoric to persuade markets they are very, very serious. Markets have called the bluff, discounted the rhetoric and consequently we may see interest rates capped around 6% regardless of inflation rates. The latter may run well beyond interest rates with no effective check. In an inflationary environment, gold often does well as investors see it as a store of value independent of depreciating currency.

The second factor moving gold prices upwards is accelerated buying of gold by central banks – particularly China. In the wake of the Russia-Ukraine war and various punitive measures imposed on Russia, numerous countries have concluded back-door arrangements to obtain vital commodities which Russia produces. Frequently these payments directly or indirectly involve gold. In addition, both China and Russia are seeking ways to end the hegemony of the U.S. dollar and gold plays a role in their plans.

Finally, we have likely entered a prolonged period of relatively high interest rates. Investors are pulling back from investments in speculative technology stocks or cryptocurrencies which promise distant returns but cannot provide yield in a high interest rate environment. The search for real yield in excess of inflation is much harder than it was a year ago and some investors see gold as a means of preserving wealth in this environment. For all these reasons, we believe precious metal prices will improve over the course of 2023, barring a sharp recessionary contraction.

Exploration results

With limited resources and tepid partner interest in new projects during 2022, we elected to focus our exploration efforts on our most promising, drill ready projects with a view to seeing them optioned in the near term.

In late 2021 and during the spring of 2022 we made significant discoveries of new gold and silver mineralization at the QA and Eastern Showings on the Bellehelen Project. We optioned this large project to Excalibur Metals in August and concluded a definitive agreement in December.

Several other projects are being upgraded to drill-ready / listing property status. We believe that the Cambridge Project could host very high-grade gold resources and Silver Range conducted a low impact hand-trenching program there with success this spring. Last winter, an important group of claims adjoining our Roughrider and Strongbox Properties came open. We re-staked the ground for Silver Range in March. In May and November, we conducted additional geological mapping and sampling on and around both properties and believe we have found connecting mineralization. In view of this, we intend to merge the Strongbox and Roughrider Properties into the Tule Canyon Project and option the ground as a package.

Finally, ATAC Resources returned our East Goldfield Project last February the day before Centerra Resources announced that they had bought the adjoining Gemfield Project and committed to rapidly advance that project. Shortly thereafter, we opened discussions with Centerra and other parties now interested in East Goldfield. To move the project along and follow-up on excellent work conducted by ATAC, we resumed fieldwork at East Goldfield in October, completing several short Packsack diamond drill holes near a new high-grade gold surface showing found by ATAC. Results are pending.

Each of the Bellehelen, Cambridge and East Goldfield projects has sufficient exploration potential and recent expenditures to qualify as Listing Projects or Projects of Merit for companies seeking new listings on the ASX, TSX-V or CSE. To facilitate this and enhance their attractiveness as Listing Projects, we will be completing National Instrument 43-101 reports on these projects in the new year. This will make them readily saleable to companies seeking new listings on recognized stock exchanges.

We also advanced other projects in our portfolio and acquired new ones by staking during 2022. Following up fall 2021 soil sampling at the Steptoe Project near Ely, crews discovered the “Handsome Jack” showing on the north flank of the project. This large, hitherto undocumented jasperiod has a large gold-in-soil response and has returned promising gold assays from bedrock samples. It is similar in style of mineralization to that being mined to the north at Newmont’s Long Canyon Mine. We believe it will attract the attention of major companies exploring for Carlin-style deposits in the area. At the Sand Springs Property near Fallon, we mapped, sampled, prospected and conducted an airborne magnetic field survey over the property in the fall. This project is clearly drill-ready and has elicited interest from several experienced Nevada exploration companies.

We also staked several new properties. In April, we staked the Ingot Property, a high-grade silver prospect in Clark County and later staked the Bankroll Property, a gold project with significant underground workings, in the Jessup District, Churchill County. Finally, we conducted reconnaissance projects in Utah and Arizona, sampling 15 new targets. We intend to follow-up favourable sampling results from any of these prospects with staking early in the new year.

Partner activities

Our share price may benefit from positive developments at properties optioned or owned by partners where Silver Range retains an ownership interest, royalty or success fee.

In August 2020, Silver Range optioned our Skylight Property in Nye County, NV to Rush Gold Corp. A listing was planned for March 2021 but difficulties ensued. This option and the project appear to be back on the rails with listing scheduled for March or April 2023. Regulators required additional exploration work on the property and this was completed by Rush Gold in November of this year. The work consisted of a deep-looking electromagnetic field survey (ELF-EM) and surface alteration mapping. We expect to release results in early January and see this project cross the start line in the spring.

In February 2021, Silver Range optioned the Michelle Project in the Yukon to Silver47 Corp., a private company affiliated with the group running Brixton Metals. They conducted exploration work on the property in 2021 and 2022 and are moving towards a spring 2023 listing. Aside from a royalty and success fees, Silver Range owns 19.9% (5,650,000 shares) of Silver47. The management team behind Silver47 is very experienced in running junior mining companies and we anticipate that this share position will be a valuable liquid asset following listing.

In July 2016 Silver Range optioned the Silver Range Project near Faro to a group affiliated with Oxygen Capital Corp. In September 2021 they announced the formation of Broden Mining Corp. and their intent to reopen the Faro Mine in the central Yukon. At one time, Faro was the largest lead-zinc mine in the western world and substantial historical (non-NI 43-101 compliant) resources were defined before the mining operation shut down in 2000. All known mineral resources in the Faro district are to be acquired by Broden Mining, subject to conclusion of agreements with the Federal, Yukon and First Nations governments. A key subordinate agreement has been held up for signing since February 2022. We understand that this agreement will be signed in due course, perhaps within the next few months. Silver Range has a royalty on the Silver Range Deposit and a 10% interest in Broden Mining, carried through to public listing. Broden has conducted drilling and sampling for the purposes of resource verification and is ready to begin work once the agreement is signed. Upon listing, Silver Range will have a valuable liquid equity interest in this large prospective mining operation.

Some of our other partners have been active in 2022 as well:

| Partner / Project | Activity | Silver Range Interest |

| Trifecta Gold Yuge Property, NV |

Drilling with best results of 25.91 m @ 3.03 g/t Au |

Royalty and success fee |

| Arctic Fox Minerals Up Town Gold Property, NT |

Lease conversion | Payments, royalty and success fee |

| GGL Resource Corp. Gold Point, NV |

Drilling, underground rehabilitation and sampling. |

Payments, royalty and success fee |

| Viridis Mining & Minerals Ltd. South Kitikmeot Gold Project |

Permitting in preparation for exploration / drilling |

Payments, royalty and success fee |

The year ahead

Our corporate objectives for 2023 are to continue building the company through:

- An aggressive integrated sales effort focused on marketing and optioning our most prospective, drill-ready projects

- Advancing several of our second-tier projects to drill-ready status

- Expanding our property portfolio by staking new projects in Nevada, Arizona and Utah.

- Improving our market liquidity through enhanced in-house investor outreach and by obtaining a listing on the OTCQB to better serve our American investors.

Our faith in the prospect generator model remains unshaken. With odds of around 1000:1 for prospects to advance from mineral showing to mine, and with elevated prices for advanced projects, the prospect generator model affords investors their best shot at participating in a discovery at reasonable cost. With 45 projects in our growing portfolio and a focus on getting them optioned and explored, the odds of success improve from 1:300 for a conventional exploration company with say 3 properties, to around 1:22 for a prospect generator of our size.

Success also comes from making carefully considered, modest exploration expenditures targeted to yield optimum results which advance the project to option in the near term. We avoid large exploration expenditures necessary for conventional drilling which do not add as much value to a project per dollar spent versus comparatively less expensive exploration activities such as geological investigations, geochemical and geophysical surveys.

The challenge posed by this strategy is that everything depends on sales and sales of grass-roots project are much harder than sales of advanced projects. Advanced projects may have been de-risked but ultimately they usually have much less upside and are much more expensive to acquire. Following the popular Lassonde curve, a significant value-add is most often the result of a grass-roots discovery. We recognize that sales are our central challenge and both John Gilbert, Chief of Corporate Development, and I have significantly ramped up our sales efforts in the past year. If these do not bear immediate fruit, they will at a later date when market conditions turn and the large network of active contacts we have created will seek new precious metals projects.

As initially stated, share price should be the prime metric by which we expect our shareholders to judge management performance. For junior mining companies, market capitalization and similar metrics are C-suite vanities, ultimately of no benefit to shareholders. Maintaining and enhancing our share price requires that we be disciplined in our spending, minimize expenditures which do not add value to the company and finance discretely to minimize dilution.

We seek to ensure as much money as possible goes into the ground in the form of cost-effective exploration leveraged to produce near term success. We take pride in having among the very lowest general and administrative expenses in the sector as these, while necessary to some extent, do not add significant value to the company. We have limited our financings to our immediate needs as we strive to make the company profitable on a sustained basis. We have done this in the face of opposition from brokers who often profit from large financings to the detriment of the company and smaller shareholders. Finally, management has a large stake in the company, aligning our interests with yours.

We hope returns to shareholders will come from share price appreciation associated with success on the part of our partners in exploring our projects. One need only look at the example of very successful prospect generators such as Altius, EMX Royalty or Globex to see what is possible. If we obtain an especially attractive project or develop a valuable package of royalties, we may spin these out into their own vehicles, again to the benefit of our shareholders. Finally, there is always the possibility that the company may be taken over by a larger company attracted to the value we have created. We have been approached twice in the past few years with offers of this nature, neither of which were sufficiently lucrative to be pursued beyond the discussion stage.

We are looking forward to 2023 and hope that with a little prospector luck and a lot of hard, intelligent work we will be successful in the coming year, to the ultimate benefit of our shareholders.

Sincerely,

Mike Power, M.Sc., CPG

President / CEO & Director